- Ср. Апр 24th, 2024

Последняя запись

Роль Google Ads в формировании общественного мнения — разработка образовательных кампаний

Google Ads — это мощный инструмент цифрового маркетинга, который используется компаниями для продвижения своих товаров и услуг в Интернете. Однако помимо коммерческой рекламы, Google Ads также может быть эффективным инструментом…

Как создать уникальную шапку для канала на YouTube

Шапка для канала на Youtube – это визуальное представление вашего бренда и содержания, которое вы размещаете на вашем канале. Это первое, с чем зрители сталкиваются, поэтому важно создать качественную и…

Продвижение онлайн-магазина — эффективное использование Google Ads

Google Ads – это мощный инструмент для раскрутки и продвижения бизнеса в интернете. Он предоставляет возможность достичь широкой аудитории пользователей, привлечь новых клиентов и увеличить продажи. Если вы владелец онлайн-магазина,…

Авито Доставка — эффективный инструмент для развития магазина и привлечения новых покупателей

В наше время электронная коммерция стала неотъемлемой частью нашей жизни. Онлайн-магазины предлагают широкий ассортимент товаров, возможность покупки без ограничений времени и места. Однако многие потребители все еще боятся делать покупки…

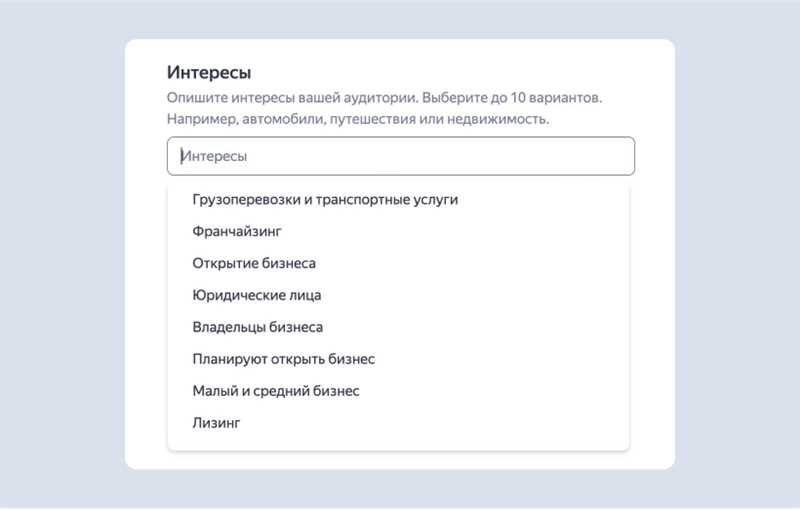

8+ инструментов «Яндекса», которые критически важны для вашего бизнеса

Бизнес в современном мире не может обойтись без обширного использования современных технологий. Новые инструменты постоянно появляются, совершенствуются и улучшаются, и они играют важную роль в развитии и успехе компаний. Компания…

Google Ads и эффективные заголовки — как привлечь внимание пользователя

В современном мире маркетинга Google Ads стал одним из самых эффективных и популярных инструментов для привлечения внимания пользователей. Однако, чтобы добиться желаемых результатов, необходимо уделить особое внимание созданию эффективных заголовков.…

Названа самая востребованная профессия в России

В наше время, когда ситуация на рынке труда постоянно меняется, определить самую востребованную профессию становится все сложнее. Однако, согласно последним исследованиям, различным источникам и мнению экспертов, можно назвать одну профессию,…

Секреты описания неизвестного — советы для авторов

Процесс написания описаний о том, о чем автор ничего не знает, может быть вызовом для любого писателя. Но существует несколько полезных советов и лайфхаков, которые помогут вам освоить это искусство…

Google Ads и сетевой маркетинг — эффективные стратегии привлечения клиентов

В мире современного бизнеса, где конкуренция высока, эффективное использование Интернет-рекламы является одним из ключевых факторов в привлечении новых клиентов. Google Ads – это платформа для размещения рекламных объявлений в поисковой…

Google Ads и обучение машин — прогнозирование спроса стало проще

Google Ads — это онлайн-рекламная платформа, которая позволяет компаниям достигать своей аудитории и привлекать новых клиентов через интернет. Однако, помимо предоставления возможности для размещения рекламы, Google Ads также имеет ряд…